As cryptocurrencies continue to change the financial world, the difference between Bitcoin and Ethereum is important for investors and fans of digital currency to understand. The debate of Bitcoin vs. Ethereum often centers on their unique features, functionalities, and other uses. They both are the top cryptocurrencies in the crypto industry. Bitcoin is designed for simple digital payments, and Ethereum supports a complex financial world. Both are the largest and most popular coins

Bitcoin serves as a value store and exchange medium, while Ethereum enables smart contracts and decentralized applications. It provides a wider range of possibilities beyond simple financial transactions.

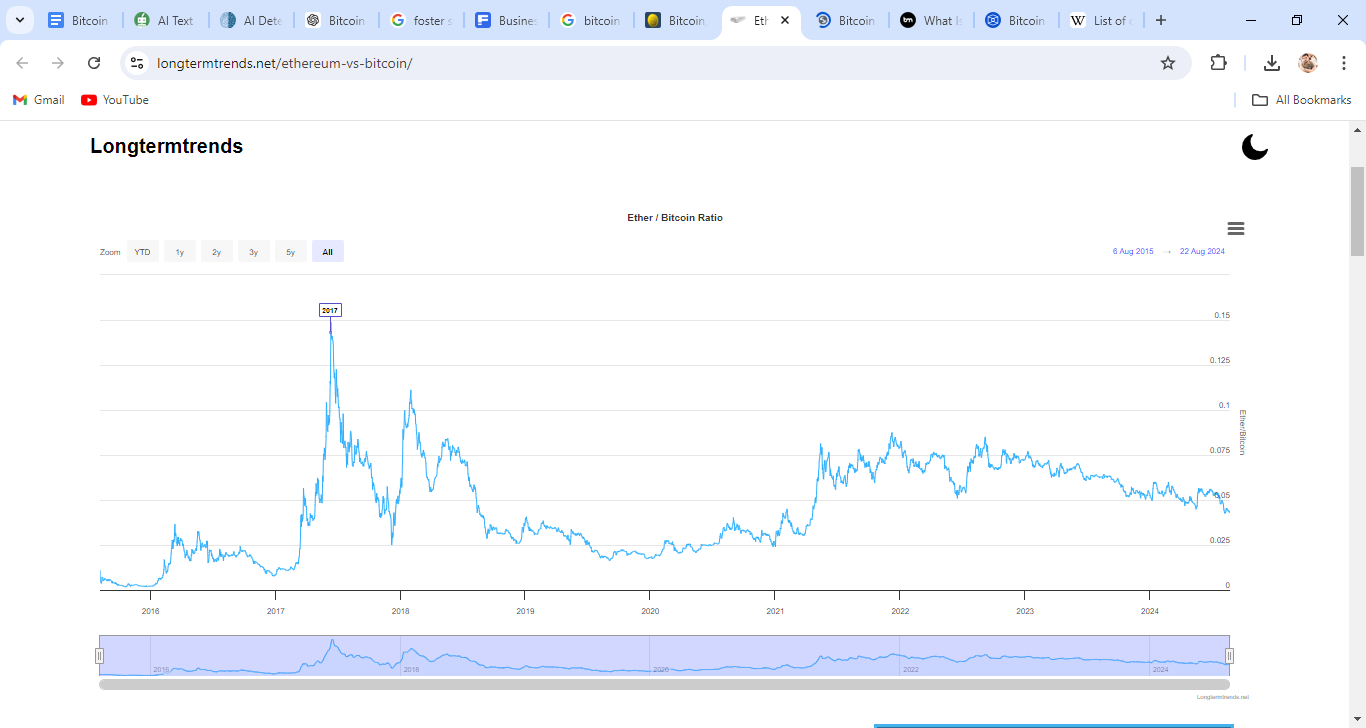

The above chart shows a ratio between Ether’s and Bitcoin’s price. It indicates the cost of buying one Ether. The higher ratio shows Ether outperforming Bitcoin.

This article explores and compares both cryptocurrencies and will help you determine which one might be right for you.

What is Bitcoin?

Bitcoin operates without a central authority or banks, allowing collective transaction management and issuing. It is open-source and public, and unlike any previous payment system, it has unique properties that make it suitable for various uses. Its design allows everyone to participate and contribute.

Key Characteristics

- Bitcoin is an open-source digital currency that allows global developers to contribute to its development without any ownership or control.

- Its 21 million-coin supply cap is like gold. It prevents inflation and mirrors limited physical resources.

- Due to blockchain technology, its transactions are secure and transparent.

What is Ethereum?

Ethereum is a global network of computers that operates under the Ethereum protocol. It provides a foundation for communities, applications, organizations, and digital assets. Users can create accounts from anywhere, anytime, and explore a world of apps or build their own.

Key Characteristics

- Ethereum’s innovative feature is its support for smart contracts, which are self-executing contracts.

- Ether is used for transaction fees, computational services, and executing smart contracts and dApps.

- Ethereum offers an alternative to traditional banking techniques by offering several financial services and products.

Comparison of Bitcoin vs. Ethereum

Bitcoin and Ethereum both operate on blockchain technology with a focus on decentralization. They are designed to serve different purposes. They both have some differences. Let’s have a look at the comparison of Bitcoin and Ethereum cryptocurrency:

Purpose:

- Bitcoin was designed to offer secure, peer-to-peer value transfer without intermediaries to provide a secure alternative to traditional money.

- Ethereum supports smart contracts and decentralized applications and serves as a global computing platform for a wide range of applications.

Technology and Functionality

- Bitcoin uses Proof of Work to validate transactions and secure the network. Its blockchain primarily focuses on transactions. Bitcoin has lower transaction throughput compared to Ethereum.

- Ethereum 2.0 transitions from Proof of Work to Proof of Stake to enhance scalability. Its blockchain is designed for transactions, smart contracts, and dApps. Ethereum offers faster transaction processing compared to Bitcoin.

Supply Cap

- Bitcoin has a fixed supply cap of 21 million coins, and new bitcoins are created through mining rewards.

- Ethereum’s supply cap is not fixed, but recent upgrades have introduced mechanisms to reduce total supply over time.

Use Cases

- Bitcoin is used for transactions, investment, and inflation hedge, with limited smart contract capabilities.

- Ethereum provides a wide range of functionalities beyond currency and serves as a host for decentralized finance applications.

Market Position

- Bitcoin is the largest cryptocurrency by market capitalization.

- Ethereum is the second-largest cryptocurrency in terms of market capitalization.

Price

- Bitcoin’s price currently leads the entire crypto market. The current live price of Bitcoin is $64,198.21 per (BTC / USD).

- Ethereum’s current live price is $2,750.82 per (ETH / USD).

Which Cryptocurrency is Right for You?

The choice between Bitcoin and Ethereum depends upon your personal goals, risk tolerance, and interests.

Here is a guide to help you determine which cryptocurrency is a better fit for you:

- Bitcoin is a strong choice for those seeking a digital asset as a long-term store of value and a hedge against inflation.

- Ethereum offers exposure to emerging technologies like decentralized finance, NFTs, and dApps, with its smart contract capabilities.

- Bitcoin is the most widely recognized cryptocurrency. It is a safer choice for those with a lower risk appetite and prefer established assets.

- Ethereum carries higher risk due to its evolving nature and other complexities. Its ability for growth and higher returns may appeal to those who are willing to take on more risk.

- Bitcoin is ideal for beginners. Its focus on simplicity makes it easy to understand and use.

- Ethereum offers opportunities for smart contracts, dApps, and new technological developments.

- To diversify your cryptocurrency holdings, consider investing in both Bitcoin and Ethereum. Bitcoin offers stability, while Ethereum exposes you to new technological trends and potential growth areas.

- Bitcoin is a popular choice for simple transactions while Ethereum is ideal for developers and users interested in building or using decentralized applications.

There is no specific answer to whether Bitcoin or Ethereum is the better cryptocurrency for you. The choice should be based on personal requirements, financial goals, risk tolerance, blockchain interest, and investment plans. There is no universally applicable answer to this.

Read also: AI for Business: Increasing Efficiency and Productivity

Wrap Up

Bitcoin and Ethereum are two prominent cryptocurrencies in the cryptocurrency world as they give unique benefits to different users. Bitcoin is a stable store of value and a hedge against economic uncertainty. Its simplicity and reputation make it a popular choice for those who want stability in the volatile digital asset market. On the other hand, Ethereum offers a wide range of possibilities through smart contracts and decentralized applications. It attracts users interested in decentralized finance, NFTs, and innovative blockchain technology.

The choice between Bitcoin and Ethereum depends on personal goals. A balanced approach combining Bitcoin’s security and Ethereum’s innovation can provide a comprehensive strategy. Understanding these differences helps make informed decisions that align with financial and technological aspirations.

Faqs

What are the risks of investing in Bitcoin vs Ethereum?

Bitcoin’s price fluctuation can lead to losses. It is secure but vulnerable to hacks or scams. Ethereum’s risks include technical issues and smart contract vulnerabilities. Its price swings can lead to substantial gains or losses.

Which cryptocurrency is better for beginners: Bitcoin or Ethereum?

Bitcoin is a popular choice for beginners because of its simplicity and clear purpose as a digital currency. It’s easier to understand and use than Ethereum.

Can Ethereum overtake Bitcoin in market cap?

Ethereum has the potential to surpass Bitcoin in the market cap if it is used in decentralized finance. However, Bitcoin’s strong value store and network effect make this outcome uncertain. Despite this, Ethereum has the potential to reach a comparable market capitalization with Bitcoin.